IN BRIEF (Page 24)

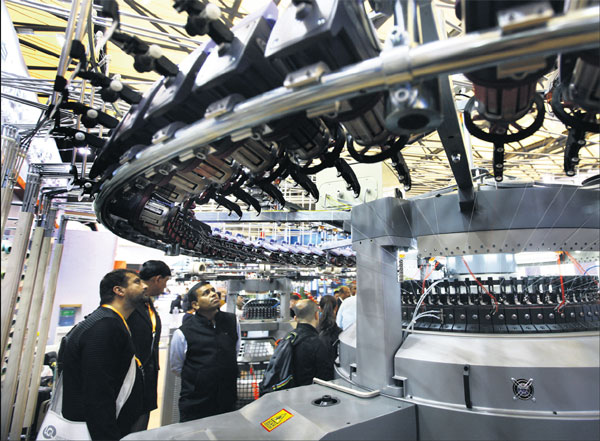

| Visitors watch live demonstrations on a jacquard loom at the 18th International Exhibition on Textile Industry held at the Shanghai New International Expo Centre on Nov 27. Xinhua |

Central bank injects funds via reverse repos

The People's Bank of China, China's central bank, injected 240 billion yuan ($36.4 billion; 30.6 billion euros; £26.9 billion) into the market via open market operations on Nov 29 to ease liquidity. The PBOC conducted 240 billion yuan of reverse repos. Meanwhile, 240 billion yuan of reverse repos matured, meaning the net cash injection was zero. A reverse repo is a process by which the central bank purchases securities from commercial banks through bidding, with an agreement to sell them back in the future. On Nov 29, the PBOC conducted 160 billion yuan of seven-day reverse repos priced to yield 2.45 percent, 70 billion yuan of 14-day contracts with a yield of 2.6 percent, and 10 billion yuan of 63-day contracts with a yield of 2.9 percent.

Yuan climate bond listed on Euronext

The first yuan-denominated climate bond issued by a Chinese bank was listed on Nov 28 on the Euronext stock exchange in Paris. The bond had been successfully issued on Nov 15 in three parts - 700 million euros ($833 million; £616 million), $500 million and 1 billion yuan - by Bank of China's Paris branch, while the order book had been oversubscribed more than 2.6 times, says Pan Nuo, head of the BOC Paris branch. The proceeds are mainly for green projects of wind power stations, Pan says. The listing of the bond on Euronext "has a special meaning", as it comes close to the second anniversary of the Paris Agreement and French President Emmanuel Macron's upcoming visit to China, says Zhai Jun, China's ambassador to France.

Shanghai Clearing House to start in London

Shanghai Clearing House will launch China's first cross-border foreign exchange clearing platform with a London partner next month to support China's further capital market liberalization and renminbi internationalization. Announcing the news in London on Nov 28, Shanghai Clearing House said it will launch the platform in partnership with the London-based R5FX, which is a clearing platform for emerging markets' foreign exchange trade. While Shanghai Clearing House will provide trade clearing infrastructure within China, R5FX will provide clearing infrastructure in London and other international markets in which it operates. The new platform is seen as a vote of confidence in London's status as a leading international financial hub despite uncertainties over the United Kingdom's impending exit from the European Union.

Pipeline helps meet rising demand for gas

The China-Central Asia natural gas pipeline had transported a total of 200 billion cubic meters of natural gas by Nov 29 since it began operation in December 2009, meeting demand in the world's second-largest liquefied natural gas importer, according to China National Petroleum Corp, the country's largest oil and gas supplier and producer. The pipeline, running through China, Turkmenistan, Kazakhstan and Uzbekistan with an annual gas transportation capacity exceeding 55 billion cu m, is the first pipeline importing natural gas from abroad by land, said Sino-Pipeline International Co Ltd, a subsidiary of CNPC and the operator of the pipeline. The 200 billion cu m of natural gas is equivalent to the total annual natural gas consumption of China or 11 years of natural gas supply for Beijing, it said.

Outbound portfolio investment up

Overseas portfolio investment from China had continued its rising streak by June with the United States as the biggest destination, according to official data released on Nov 27. China made about $420.6 billion (354.9 billion euros; £312.5 billion) of portfolio investments, including investments in equities and bonds, in overseas markets by the end of June, the State Administration of Foreign Exchange said. The reading was nearly 35 percent higher than that of a year ago. China made $255.1 billion of equity investments and $165.5 billion of bond investments.

Rolls-Royce, train maker 'on a new footing'

A corresponding agreement has been signed by Rolls-Royce Power Systems and China Railway Rolling Stock Corp, both of which decided to grow and deepen their successful partnership, the Rolls-Royce Power Systems announced on Nov 29. Among the matters of agreement is a commitment by CRRC to continue to consider MTU engines from Rolls-Royce in its locomotives and diesel rail cars. The two companies also agreed to collaborate on future power delivery solutions, including hybrid drives and gas engines. "This strategic partnership agreement is a major step forward in strengthening our successful collaboration with Rolls-Royce Power Systems and MTU," said Dayong Chen, general manager for International Business at CRRC, which is China's largest train manufacturer. Rolls-Royce Power Systems AG chief executive officer Andreas Schell said, "We are proud that we are consistently convincing CRRC, one of the major players in the global rail market, of the quality of our drive solutions. Our close working relationship has been established firmly in recent years, and this agreement puts it on a new footing - something which is going to benefit both partners and our customers as well."

Cargo clearance system expanded

The nation is expanding a single-window system that enables faster and cheaper cargo clearance across the country. The General Administration of Customs announced on Nov 27 that a standard version of the platform now covers all trade ports with a total of 35,000 registered users and more than 100,000 daily declarations. GAC spokesperson Huang Songping said it combines the functions of 11 agencies and provides 129 services ranging from declaring goods to checking business qualifications. Instead of filing the same information repeatedly with different authorities, traders are able to declare cargo and taxes with a single submission on a web-based platform, improving efficiency and reducing costs.

CNNC unveils new nuclear reactor

China National Nuclear Corp, one of the country's largest nuclear companies, introduced a low-temperature heating reactor, the DHR-400, for residential heat generation, replacing coal-fired boilers, as China aims to reduce coal consumption to curb pollution. The reactor, which sees 60 years of service life, can be applied either in the inland or coastal areas and provides cheap and sustainable electricity compared with other traditional fuels, including coal and natural gas. A 400MW heating reactor can provide heating for an area of 20 million square meters, it said.

Lottery sales rise 11.3% in October

China's lottery sales rose by 11.3 percent year-on-year to 37.65 billion yuan ($5.7 billion; 4.8 billion euros; £4.2 billion) in October, according to the Ministry of Finance. Sales of welfare lottery tickets increased by 5.8 percent year-on-year to 18.31 billion yuan last month, while sports lottery sales went up by 17.1 percent to 19.34 billion yuan, the ministry said. Last month, 29 provincial-level regions saw growth in lottery sales, driven by strong sales in Hunan, Guangdong, Anhui and Jiangxi provinces as well as Chongqing, according to the ministry. In the first 10 months of 2017, lottery sales went up by 7.7 percent to 348.43 billion yuan, while sales of welfare lottery tickets and sports lottery tickets increased by 4.9 percent and 10.7 percent, respectively. Under lottery management rules, money from lottery ticket sales must cover administrative fees, public welfare projects and prize money.

(China Daily Africa Weekly 12/01/2017 page24)

Today's Top News

- Global medical minds unleash hospital innovation trends

- Xi holds phone talks with Vietnam's top leader To Lam

- Chinese, Sri Lankan presidents hold talks in Beijing

- Xi's article on further deepening reform comprehensively to be published

- China-UK dialogue outcomes will enable them to reboot relationship

- Stellar Olympic performances spark craze for emerging sports